Section 179 Tax Deduction (capital equipment investment deduction)

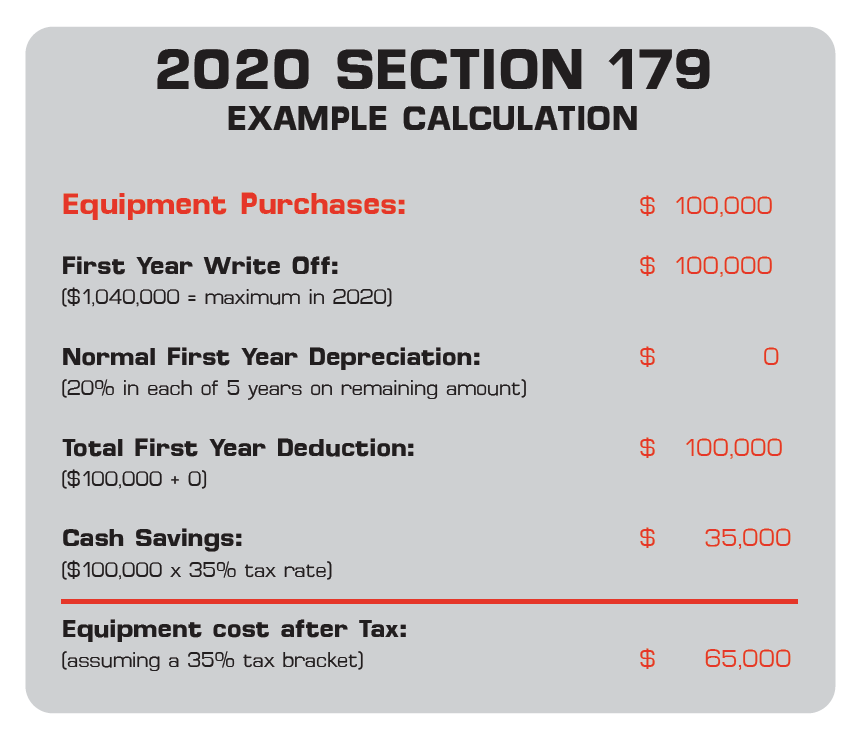

The section 179 tax deduction is designed with businesses in mind. It is meant to be an incentive to encourage businesses to invest in themselves, with new equipment. It allows businesses to deduct the full purchase price of qualifying new and used equipment up to $1,000,000 purchased or financed in the tax year. The code states that equipment must be placed into service between January 1, 2020, and December 31, 2020, to qualify for the deduction in the 2020 tax year.

Why am I telling you all of this?

Our current orders are being quoted out to November meaning that if you plan to take advantage of the write-off, you’ll need to get your orders in soon.

LS Industries wants to help you save money not only on your taxes but in your production. Our automated blasters, washers and vibratory equipment will significantly increase your productivity and reduce your labor costs.

Find out more about new equipment tax deductions at www.irs.gov or consult your tax accountant.

Please contact LS Industries to see how we can help you.

Need to finance your equipment? We have lending partners as well that can help you move forward with your new equipment needs today as well. Financed equipment is still eligible for the Section 179 tax incentive for new equipment deductions.

Need a custom solution to get your production moving smoothly? We still have time to build the new equipment before the end of the year but you need to act fast!

We do also have some stock solutions available for increasing your productivity tomorrow. Take a look at some of the end of the year offers we have available on new and used equipment. New Equipment or Used Equipment